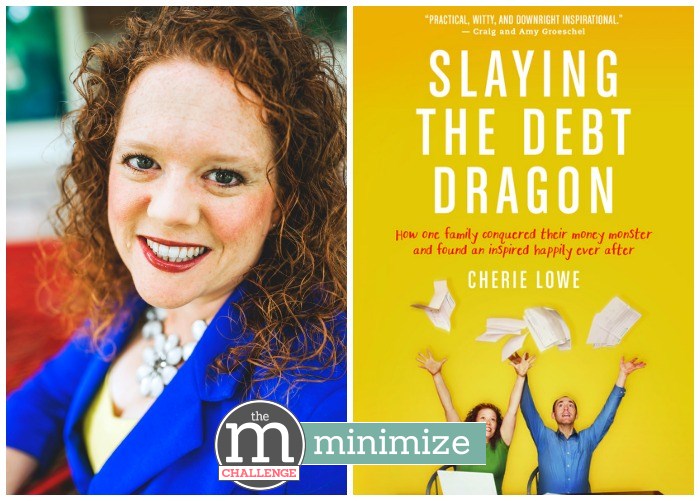

Cherie (The Queen Of Free) and Brian Lowe

In 2008, Cherie and Brian Lowe found themselves under a massive pile of debt. Between student loans, credit cards, car loans and gap loans…the husband and wife were in debt $127,000.

“At that point, we had been married just about nine years and really we just didn’t have a plan for our money,” Cherie tells CNBC Make It. “We lived paycheck to paycheck, and when a crisis would arise, if we didn’t have the cash to pay for it, we would put it on the credit card.”

After months of frustration, Brian came home from work one day and shared with Cherie a vision of what life could look like, debt free. So in April of 2008, the couple set off on a 15-year-plan to save money and become debt free!

Just four years later…in March of 2012, the couple made their last loan payment and were 100% debt free! So much for the 15-year part of the plan!!

The pair conquered $127,482.30 in debt and interest, which Cherie documented on her blog, Queen of Free, and in her book, “Slaying the Debt Dragon: How One Family Conquered Their MoneyMonster and Found an Inspired Happily Ever After.”

To reach their goal, the couple worked together to both increase their income and slim down expenses. While many larger factors contributed to their success, including building an emergency fund, rejiggering their tax withholdings, taking on side hustles, giving up restaurant meals and living with less, Cherie’s No. 1 money–saving trick is simple.

“Every time you check out at the grocery store, you need to look in your cart and find three to five items that you don’t need,” she says. “You will save $5 to $10 every time you shop without cutting a single coupon.”

The plan works for a simple reason. It places a barrier between putting an item in your cart and actually paying for the item at checkout. If you don’t need it. Don’t buy it.

In relation to that money saving tip, Cherie recommends always going grocery shopping, or any type of shopping for that matter-with cash only. If you have plastic on you, you will spend far more than needed.

Cherie is open about how easy it used to be to just swipe her card and buy whatever she wanted.

“I absolutely had to stop carrying my cards with me, because I was just too swipe happy,” she writes in her book “The Recovering Spender.” “I had zero self-control.”

Setting boundaries like the ones above can do wonders for saving money. The proof is here and if you stay dedicated to your money saving techniques…they will pay off in a big way!