Dave Ramsey is a master when it comes to making money and helping others make money as well. We wanted to share a bit of advice from Ramsey that shows very simply how starting to invest a small amount of money early in life, can yield you huge results!

Even though this article is geared towards starting to save money early, it doesn’t mean that it is too late for others, say in their late 20’s or early 30’s. As Ramsey states, the key is starting the saving plan as soon as possible.

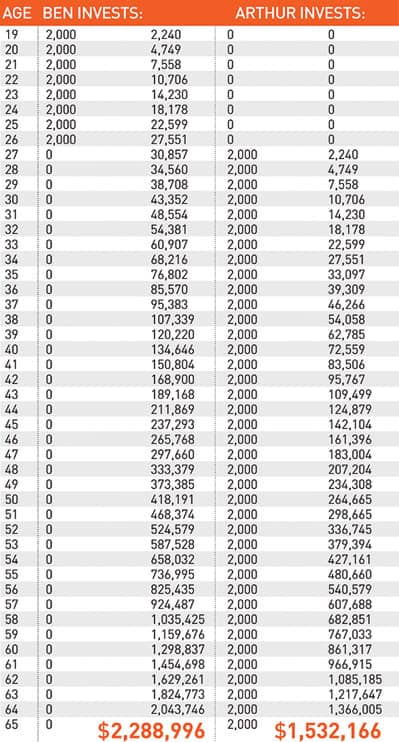

Check out the illustration below, it is very compelling and has huge wow factor!

(The following is from DaveRamsey.com)

Ben and Arthur were friends who grew up together. They both knew that they needed to start thinking about the future. At age 19, Ben decided to invest $2,000 every year for eight years. He picked investment funds that averaged a 12% interest rate. Then, at age 26, Ben stopped putting money into his investments. So he put a total of $16,000 into his investment funds.

Now Arthur didn’t start investing until age 27. Just like Ben, he put $2,000 into his investment funds every year until he turned 65. He got the same 12% interest rate as Ben, but he invested 23 more years than Ben did. So Arthur invested a total of $78,000 over 39 years.

When both Ben and Arthur turned 65, they decided to compare their investment accounts. Who do you think had more? Ben, with his total of $16,000 invested over eight years, or Arthur, who invested $78,000 over 39 years?

(Words from daveramsey.com)

Believe it or not, Ben came out ahead … $700,000 ahead! Arthur had a total of $1,532,166, while Ben had a total of $2,288,996. How did he do it? Starting early is the key. He put in less money but started eight years earlier. That’s compound interest for you! It turns $16,000 into almost $2.3 million! Since Ben invested earlier, the interest kicked in sooner.

What You Can Do Now

The trick is to start as soon as possible. A survey by Charles Schwab found that 24% of teens believe that since they are young, saving money isn’t important. Looks like we just blew that theory out of the water! That same survey also discovered that only 22% of teens say they know how to invest money to make it grow. Why not change that stat and learn how to become a smart investor with your money? Talk to your parents or teachers about how to open up a long-term investment account so you can become a millionaire, too. And remember, waiting just means you make less money in the end. So get moving!