Source: https://www.floridacapitalbank.com/

Money problems can be bad for your health. Couples often break up because of money troubles and dealing with something like a bad mortgage can cause constant anxiety. However, people who are saving money, using a sensible budget, and investing will live a much healthier life. There are a few tips below that will explain how money can help you get healthier or might cause health problems.

Anxiety

Money can cause anxiety if you are not using a monthly budget, you have a lot of debt, or you do not know how you will pay for an emergency. You may rely on fast food that is not good for you, and you may work so hard that you begin to lose sleep. Your relationships may begin to suffer, and you will have a hard time thinking about the future.

You Can Eat Better If You Are Budgeting And Saving

You will start to eat better when you are budgeting and saving. You will have enough money in your budget to pay for good food, and you can afford to go out to eat now and then. You are improving your outlook on life, and you are not worried about feeding your kids.

Debt Can Make You Sick

If you are anxious, you are prone to getting sick more often. People who have not fully-addressed their debt will remain sick because they do not know what to do, and people who do not have a monthly budget will not know how they are going to manage their money. If you are sick, you are missing work. You will not have enough money to pay your bills, and your problems will get worse.

Source: https://makingmomentum.net/

If You Are Saving, You Can Plan For The Future

If you are saving money and investing, you can start to think about the future. You and your partner can think about what you want to do when you retire, or you can plan to buy a bigger house for the family. You will not have as much anxiety about money because you can make concrete plans for the family.

If you are investing with a broker, you also get peace of mind knowing that you are working with a professional. People who are investing can watch their investments grow, and people who are saving money feel better because they can see the money in their savings account.

Emergencies May Be Difficult For The Family

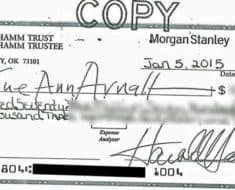

Line of credit loans can be useful in times of financial strain due to unexpected emergency expenses. For example, a short-term loan could be helpful if you or a loved one is faced with unexpected medical fees that cannot be covered by your savings alone. Line of credit loans should only be considered as a last resort, but they can be helpful if you are not sure how to resolve your unexpected expenses while still handling your day-to-day financial responsibilities. This may be the perfect time to write out a budget and start saving money just in case.

Conclusion

Managing money can be very bad for your health but dealing with your debt can help improve your outlook on life. Someone who has a lot of debt, no budget, and no emergency funds may be nervous all the time. These people might get sick more often because money is making them feel anxious. Plus, these people do not have the energy to deal with their debts or monthly budget. However, you can create a family budget, save money, invest, and begin to live a healthier lifestyle. If you are less stressed, you will enjoy life more and can manage your money with a bit of wisdom. Do not let money make you sick!