Via: Forbes

Although the $2 trillion stimulus bill passed last month includes payments of up to $1,200 for everyone who makes less than the limit, many Americans won’t get a payout and they will simply fall through the cracks of the system. This is due to a series of guidelines that says who does and who doesn’t qualify for the payout.

Here are some situations that would cause you to not receive a payout.

College students and 17-year-olds

If someone else claims you as a dependent on their taxes, you won’t get your own check. Parents will get an extra $500 payment per child, but that’s only for kids under 17.

Most 17-year-olds, some young adults and many of the country’s roughly 20-million college students are claimed by their parents as dependents. They won’t get checks, and their parents won’t get an extra $500

“They’re not on their own. And so you feed them and you still provide for them,” said Susan Anderson of Lubbock, Texas, who has a 19-year-old at home and a 23-year-old about to graduate from college. “So you’re not getting anything, and they’re not getting anything. There’s a huge gap.” (Via: NBC)

Disabled people whose parents support them

People who get disability benefits from the Social Security Administration or Veterans Affairs are eligible for the payments — however, disabled adults who are claimed as dependents by their parents or other relatives on their taxes, are not eligible.

Seniors living with their kids

Senior citizens who are on Social Security or make less than the income cap are eligible. But the “dependent” rule applies to them, too. Some seniors who live with their adult children or other relatives are claimed by them as dependents on their taxes. Those seniors won’t get checks.

Immigrants without Social Security numbers

You don’t have to be a U.S. citizen to get a payment. But you do need a valid Social Security number.

That means immigrants with green cards and those on H-1B and H-2A visas will get payments. Nonresident aliens, temporary workers and immigrants in the U.S. illegally will not.

Babies born in 2020

The $500 payment per child, like the individual payments, is based on 2019 taxes. So parents who welcomed babies into the world in the first months of this year won’t get money for them now. Instead, it is said they will more than likely get $500 credits next year when they file their 2020 taxes.

High earners who lost their jobs

The size of the payments starts scaling down for those who made more than $75,000 last year and zeroes out at $98,000 or more.

But what if you exceeded the limit in 2019 only to lose your job or get a lower-paying job this year? You won’t get a payment now, but you will get a credit on your taxes next year when the system catches up.

Parents who split custody

Some parents who aren’t married and split custody of their kids take turns each year claiming them on their taxes. Because the payments go off your 2019 tax return, whoever has the even years is simply out of luck.

Recently divorced or estranged

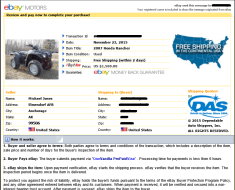

Couples who filed their taxes jointly last year get a single, combined payment of up to $2,400. The funds will be deposited into whatever bank account was used to deposit your most recent tax refund, unless you update your direct deposit information with the IRS. But there’s no system to inform the IRS that you have divorced or are estranged.

So it will be up to the person in which the bank account the money was deposited…to split it up with the ex! Yikes!

People who owe back child support

The stimulus law puts on hold other debts that typically lead to tax refunds’ being garnished, such as overdue student loans or back taxes. But not child support. The coronavirus money can still be garnished if you’re overdue on those payments.