Everyone loves to save a little extra cash and it’s a lot easier than you think to do! A few dollars saved here and a few dollars saved there add up quickly over time! Those extra dollars can be put to good use…like a vacation! 🙂

Here are a few tips on how you can save some extra cash every month! If you stick to a plan to save, you just might surprise yourself as to how much money you actually spend foolishly every month!

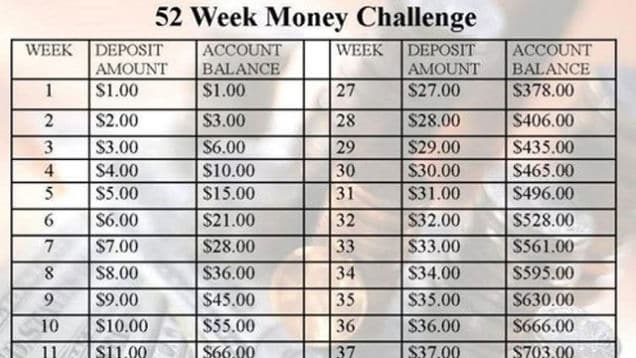

1. 52 Week Money Saving Challenge

Try the 52-week challenge. Yep, there are 52 weeks in the year, but that doesn’t mean it has to be a new year before you start this one. This one is so painless you won’t even feel it. All you have to do is commit to put away the same amount of money as which week it is. So for week one, save $1. Week two, save $2, and so on. Keep doing this every single week until you save $52 at week 52. By that point, you will have saved over $1300. See, pretty painless!

2. Get Rid Of Cable

Cable is so incredibly over priced. Check out satellite or better yet, just utilize services like Netflix, Hulu and Amazon!

3. Earn Cashback While Online Shopping

You can join Ebates for free, it’s easy to use, and you’ll earn up to 40% cash back on every online purchase you make. {Including Amazon!}. It’s really a no-brainer if you are an online shopper!

4. Don’t Buy Coffee

Check out this article for some delicious homemade iced coffee recipes. Think about it…if you spend an average of just $3 each day on Starbucks or Dunkin Donuts, multiply that by an average of 28 days and you’ll save at least $84 each month. Wow is right!

For years I bought at least two coffees per day from Dunkin Donuts…in reality it was four because I would buy one for my girlfriend as well. That’s Roughly $5 per day on me and $5 per day on her. I did this every single day for years and I know I wasn’t alone in doing so. So $5 x 365 days is a whopping $1,825 per year in coffee alone. That’s just my cut…multiply that by two! I think I’m going to be sick! Yikes!

5. Pack A Lunch

Eating out every day for lunch is a financial killer. You may not notice it, but it adds up and costs you a ton of extra money! Try going grocery shopping and packing your own lunch daily!

7. Don’t Buy Name Brand

A lot of the times name brand items are no different than the stores brand of the same item. Try substituting name brand items for store brand. You can save some serious coin this way!

8. Don’t Buy Bottled Water

If you have clean drinking water at home, utilize it! Buy a water bottle and fill it up often! There is no need to buy 30 bottles of water a week if you have clean, fresh drinking water right in your kitchen tap!

9. Get Rid Of Your Landline Phone

Still have a landline phone? Consider getting rid of it! You already pay for a cell phone bill, so why pay for two phone services!

10. Driving More Efficiently

Believe it or not, driving more efficiently and keeping up with proper tire pressure saves you on the fuel costs of driving your car. Getting regular oil changes and changing the air filter will also save you money on gas as it will increase your car’s gas mileage!