Thebalance

Throughout the pandemic there has been a rise in sotck and forex investing by retail investors. In other words, disposable income has risen for everyday people due to a reduction in leisure spending, and this money is being funneled into stocks and Forex. Here are some of the key reasons why forex brokers and currency is on the tip of everyone’s tongue right now.

Accessibility

Forex used to be difficult to get into. It was complicated, and forex brokers did not exactly try very hard to attract beginners. Nowadays, there’s been a rise in brokers as listed on Topbrokers.com which are directly targeting beginners with promotions, user-friendly UX/UI, and easy-to-use apps. Investments are made simple without the jargon, which is why there has been a flood of retail investors speculating on currencies. Knowledge and education on the subject is also easir given the abundence of Forex Youtube material.

Longer trading hours

Unlike equities markets which have weekends and opening/close times, currencies are almost 24/7. This means that trades can take place at almost any moment, so there are more opportunities in a given day. This is particularly important if you have a trading bot that never sleeps too, as it could be operating throughout the night.

Scope for profit

There is a large scope for profit in Forex — much higher than most investment products. You can make money whether currencies go up or down, along with leveraged margin trades which can significantly increase your profit margin even with little starting capital. Further, forex is a two-way market, so not only can you make money from a swing either way, but also with that currency’s pairing. It’s also easy to start small and work your way up.

Liquidity

If you invest in real estate or private equities then it takes a long time to convert those investments back to cash. Currency however is already liquid, and if you want to convert it back to your base currency, it can be done almost immediately. A standard broker, secondary markets or through other means such as using cryptocurrency as a stepping stone, Forex investments are extremely liquid.

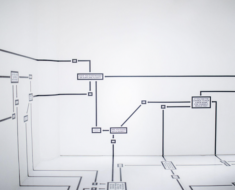

Algorithms and bots

If you’re a fan of rule-making as well as programming, you can very quickly build trading algorithms that execute commands automatically. For example, if you have a handful of indicators, such as a currency’s price, moving average, resistance line and so on, you can programme the algorithm to know when to buy and sell. This can be either backteted or simply simulated using a fake-money demo on an appropriate brokerage to see if it’s profitable.

Final Word: Turbulency

There is a lot of volatility in this market currently, with the rise in retail investors’ speculations and a pandemic. This means you should be cautious with Forex, but it could mean a greater profit potential. Where there’s sharp price movements, there’s fast profit opportunities. For this reason, the current market seems better suited to day traders and technical analysis compared to long-term strategies and fundamental analysis.

Before starting, ensure you have a firm grasp of market fundamentals and currencies. It’s important to also know which currencies historically have correlations, and which do not, along with how other commodities affect such prices — for example, Gold and USD’s relationship.