Medium

Accounting groups want plenty of time to manage, trace, and combine rate reimbursements. They want to do many efforts that are time-consuming as well. Therefore, it is tedious for them. Expense repayment needs to no longer be time taking and annoying. Therefore, fee administration can make repayment easy. In this article, we will talk about all Expense Reimbursement.

Expense Reimbursement – Overview

Expense compensation is when agency people spend cash on the behalf of the agency throughout the enterprise journey and declare the cash lower back from companies. Commonly, they are additionally referred to as compensation to employees by way of the employer for the cash that they spend on the behalf of the company. Such compensation may also be one of a kind relying on the limits set by an organization in its cost policy.

Illustration

A comprehensible instance of rate repayment is when an employee can pay for workplace supplies, equipment, or other different cost and then demand or collect the cash again from the company. For this purpose, when people purchase something or pay for something on the behalf of a company, they can demand their cash lower back from the business enterprise if they had any proof that they spend their cash like receipts archives and cost reports.

What is considered as a workers’ business expense?

You can classify your enterprise fee in many ways. However, the sole thing, which matters the most, is that any quantity paid with the aid of the people for organizational prices comes in the class of employee enterprise expense. The predominant element is that it must obey the company’s journey and price policy. Following are some classes for which enterprise rate repayment is valid:

• Maintenance and journey expense

A lot of cost compensation consists of costs falling below this category. Business journeys want personnel to pay for many prices that personnel pay on the behalf of the organization. You can file the commercial enterprise journey costs in the shape of a single report, which consists of every kind of touring rates like charges, transport, inn expenses, and some other kind of essential matters for traveling. Therefore, all the expenses, which fall in this category, are legitimate for reimbursement.

• Customer enjoyment and foods

To elevate the commercial enterprise’s relationship with customers, people might also set a sitting with clients for meals. In such situations, the employee can pay for food all through their enterprise traveling. Therefore, such charges will be universal for reimbursement.

In many situations, people may also work out from one-of-a-kind locations. Therefore, it is essential to make sure of suitable conversations between your workers. Therefore, they can also declare repayment for connectivity expenses.

In addition, if workers pay for your workplace accessories, supplies, and equipment, it additionally comes in the class of reimbursement. Any incidental rate that is paid through your employees on the company’s behalf can be typical for reimbursement.

How employees must record reimbursement prices?

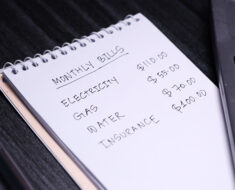

A top and dependable way to record prices for compensation is to make a price report. A cost record shows the whole thing for which employees pay for any cost on the behalf of the organization. Some of the matters that a cost document needs to comprise are cited below:

• Worker information

The modern-day date on which they pay for the expense

• Expense categories

Date and day when such expenses had been experienced

• Approving supervisor information

The journey price record represents statistics deeply so, it can assist employees to declare reimbursement. Expense receipts help the price document properly with the aid of proving the transactions and prices so, people can effortlessly declare for repayment.

How organizations can manipulate cost reimbursement?

Reimbursement is a difficult and serious phase of rate management. By following the way stated below, you can correctly manipulate the cost reimbursement:

• Track employee expense

In monitoring employee expenses, a dearth of spend, visibility is an essential problem that the finance crew faces. If you have to declare reimbursement, you have the fundamental information to show your declaration is true. Therefore, you ought to make higher spending visibility, which allows organizations to make higher selections due to the fact they hint at workers’ expenses.

• Accounting

When it comes to reimbursement, guide accounting is very essential with the great cost policy. Companies must do accounting to hint at the employee rate and the cash that they spend.

• Receipts

Companies may also additionally demand fee receipts from the people to show their claims are true. It helps companies to test the fee validity for reimbursement.